|

1. Money, Interest and Aggregate Demand

(MKM C15/379-82;

401-3; 410-13: 356-59; 376-77; 384-87;

366-368; C16/395-396; 340-342;

371-372)

- how fiscal and monetary policy affect real GDP and the price level

a) Equilibrium Expenditure & Interest Rate

- will show that equilibrium expenditure depends on investment which in turn

depends on interest rate; therefore equilibrium expenditure and real GDP depend

on interest rate

i- Money Market

- Let us assume that MS determined by central bank, i.e. for purposes of this

analysis MS is fixed or 'given' and therefore 'inelastic'

- we know that demand for money (MD) depends on level of real GDP and that any

level of real GDP MD will be downward sloping varying according to the 'price of

money', i.e. the interest rate

- therefore for any given level of real GDP (P&B

Fig. 29.1 a) there will be an equilibrium point

for MD and MS defined by the fixed level of MS and a specific interest rate

ii- Investment & Interest Rate

- we know that investment is inversely related to the interest rate, i.e.

investment will increase as the price of money falls

- therefore given the equilibrium price of money determined in the money market

there will be a specific level of investment

iii- Equilibrium Expenditure

- investment is part of 'autonomous expenditure' including government spending

and exports

- assuming given levels for government spending and exports, total autonomous

expenditure will be measured by a specific intersection point of the AE curve

and the x-axis depending on the level of investment determined by the interest

rate which in turn is determined by equilibrium in the money market

- induced expenditure (consumption less imports) increases from this point of

intersection at a slope reflecting, primarily, the marginal propensity to

consume (adjusted for the impact of the tax rate and marginal propensity to

import)

(R&L

Fig. 22-3)

2. Fiscal Policy & Aggregate Demand

- assume government pursues expansionary fiscal policy, i.e. will increase G (P&B

Fig. 29.2)

a) First Round

-

increase in G shifts AD curve to right

-

higher price level, higher real GDP

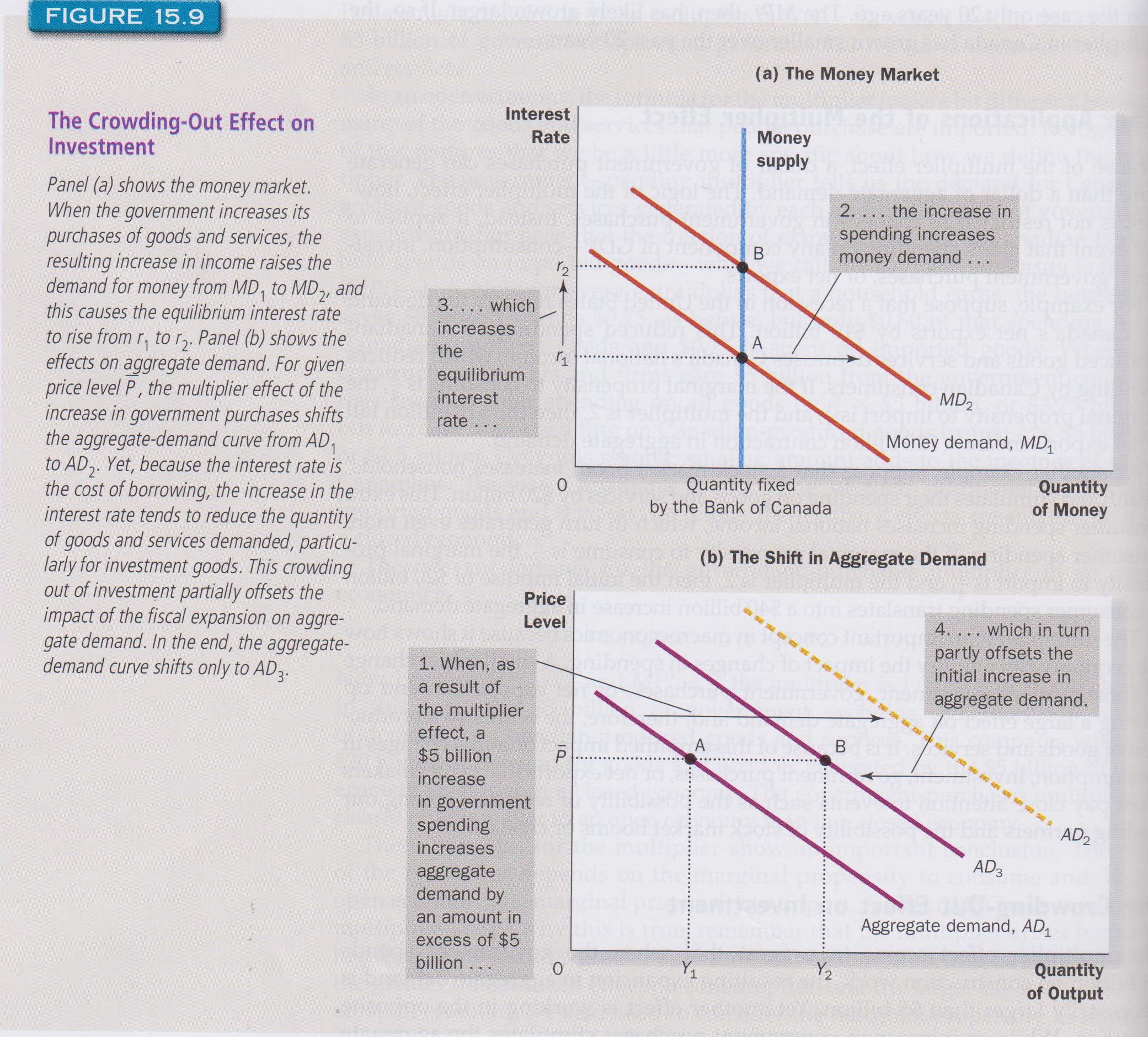

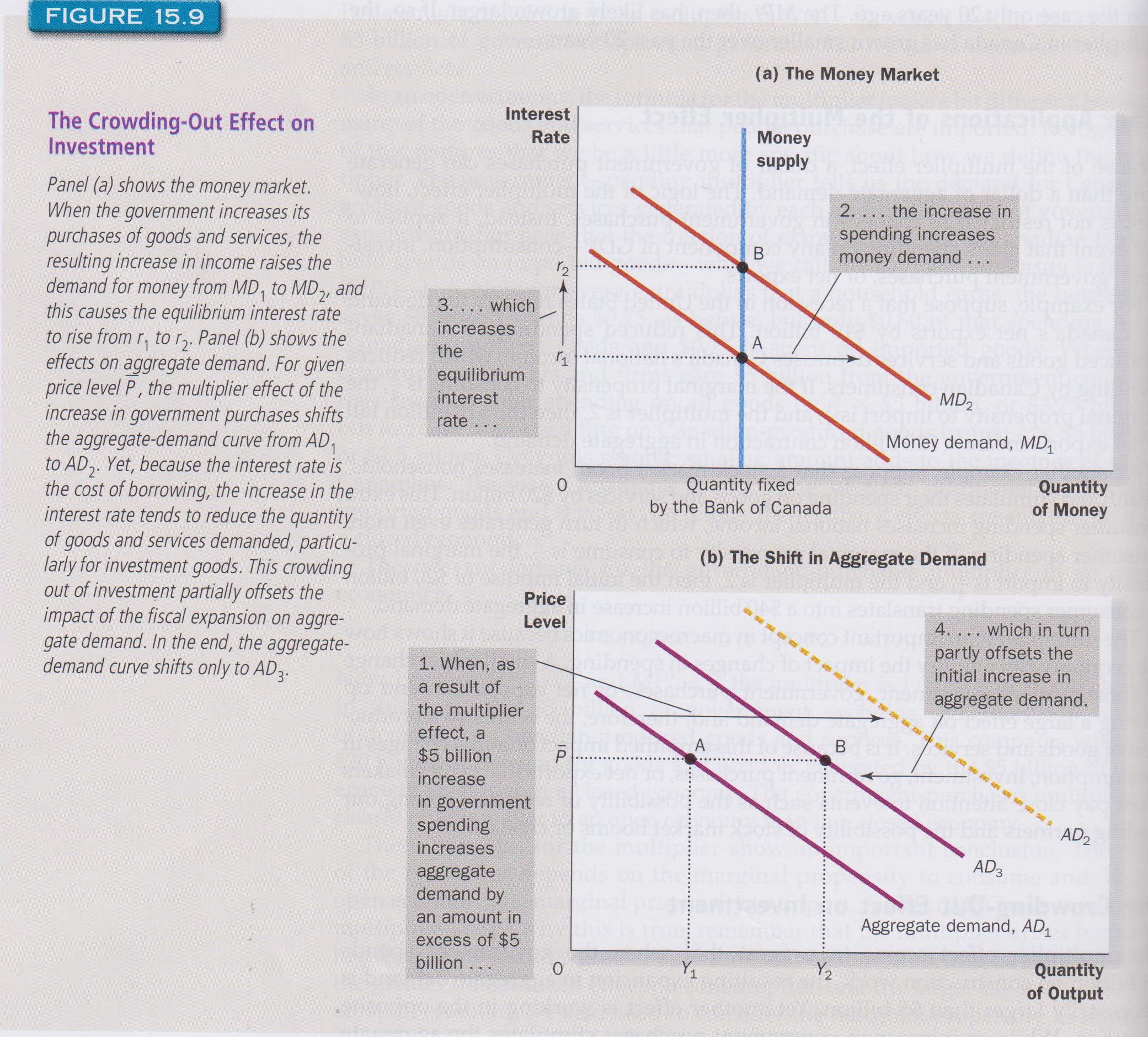

b) Second Round

-

increase in real GDP increases demand for money MD1 to MD 2

-

increased demand for money raises interest rate decreasing I causing AD

to shift to left

-

but upward movement along new AD curve reflecting rising price

level to attain new equilibrium which decreases real supply of money

which increases interest rate further (P&B Fig. 29.3)

c) Other Fiscal Policies

- increase in G is only one fiscal policy tool available to government.

Another is a change

in transfer payments but its impact will be different because of differential effect on MPC,

i.e. lower income households have higher MPC therefore it will change slope of

AE

- Government can also change tax policy, e.g. a change marginal tax rates will similarly change slope of AE by

its impact on MPC

- All these changes will affect interest rate and hence investment and hence AE

and AD.

d) Crowding Out and Crowding In ( C8 178;

C 16 389-392; C8

163; C 16

365-369

- Government borrowing on the financial markets will reduce Investment (I)

through 'crowding out'. Thus government borrowing increases money demand

raising interest rates which causes investment to fall (R&L 13th Ed

Fig. 32.6; MKM Fig. 15.9).

- This may be partial or complete but usually partial - This may be partial or complete but usually partial

- However, if increase in G is spent on improvement in infrastructure this can reduce costs of

doing business and therefore increase I; or, if the increase in G increases the

expectation of economic growth I may increase even if interest rates go up

because of

business expectation of improved opportunities;

- Similarly, a decrease in business may also increase I.

The impact of improved infrastructure and reduce business costs as well as

decrease in business taxes can lead to ''crowding

in", i.e., increased I

- All things being equal crowding in less likely.

e) Exchange Rate and International Crowding Out

- An increase in interest rate tends to increase value of a currency on world markets

as foreign funds flow to higher rates.

- There are various effects of an appreciating currency: (i) decreases X reducing

autonomous expenditure; (ii) increase in imports decreasing induced expenditures (C-M);

(iii) increase in foreign investment increasing I raising autonomous expenditure.

3. Monetary Policy and Aggregate Demand

- Let us assume the central bank decides to pursue expansionary monetary policy.

The effect will depend on the elasticity of the investment function. The

more elastic, the greater the effect; the more inelastic, the less the effect

(R&L 13 Ed

Fig. 28-10).

a) First Round

-

An increase in the MS shifts the curve to right decreasing interest rate and increasing I.

This leads to an increase I shifting AD curve to right increasing real GDP and price level (MBB not displayed; P&B

Fig. 29.5).

b) Second Round

-

The increase in real GDP, however, increases MD shifting the curve up to right.

The upward movement of AD curve causes a rising price

level (to attain new equilibrium) which decreases real supply of money

which increases interest rate further (P&B

Fig. 29.6).

|